Digital Legacy

Digital Assets might include -

- Email accounts –Xtra, Hotmail, Gmail

- Social Media sites – Facebook, Pinterest

- Online Shopping – Trade Me, Amazon, PayPal, Countdown

- Air NZ frequent flyer, Fly Buys

- TAB online betting

- Media Sites –Netflix, Lightbox. Microsoft

- File Sharing – Dropbox, Google Drive, One Drive

Chances are, most members of SeniorNet have some of the above links. This article is aimed at exploring the need to deal with those links in a way similar to the way we deal with our none digital assets, often in a Will.

Many of us have taken action to identify our wishes with regard to your tangible assets and it is suggested that we need to give a thought about how our digital assets should be dealt with.

If one were to pass away tomorrow, would family/friends be able to access digital photos, deal with emails, online investment accounts? Would they even know they exist?

Digital Property Ownership

In the online world, digital assets are often not owned by the user. All Microsoft applications, for example, are held by the user under a licence which agreed to by the user (a box was ticked) when installing the application.

Digital properties such as photos on a computer hard drive are the user’s property, however, photos that have been uploaded on Facebook or other media are often owned by the media’s provider who has given the user a licence to share the photo or post but no ownership rights. One would think that on the death of the user, these licenses expire. But as of 2012, 30 million Facebook users had already died and 10,000 Facebook users were dying every day.

For many, the concern will not be regarding the legality surrounding ownership but will be the emotional side, for example needing to access photos of their loved ones for funerals or keepsakes. This also applies to emails, depending on the circumstances of a death sometimes grieving parents will want to access their children’s emails in an attempt to find out information about their children.

There was a case on Fair Go recently of a widow unable to get photos off dead husband’s iPhone, and Apple will not unlock it for her.

With such digital assets governed by the licence agreed to by the user, the rules allowing the disposal of such assets by way of a Will do not apply. The licences are usually not able to be transferred or if they can, those terms may limit transfer in some way. Each web service provider will have specified terms of use and a different set of rules or policies.

A difficulty often experienced is that media and software platforms have varied rules as to what authority if any they will give to the executors and what proof is required of that authority. If a platform is based in another country, New Zealand testamentary rules will not be binding given that California law and jurisdiction was invoked when I accept was clicked. Very few people read all of a platform such as Facebook ’s terms of use and understand that they have created something that is not exclusively theirs.

If a platform does cover the death of a user in its terms and conditions, the process will be different to any other deals and, the provider can change these rules whenever they like.

What Happens to Digital Property?

Here a few processes in place:

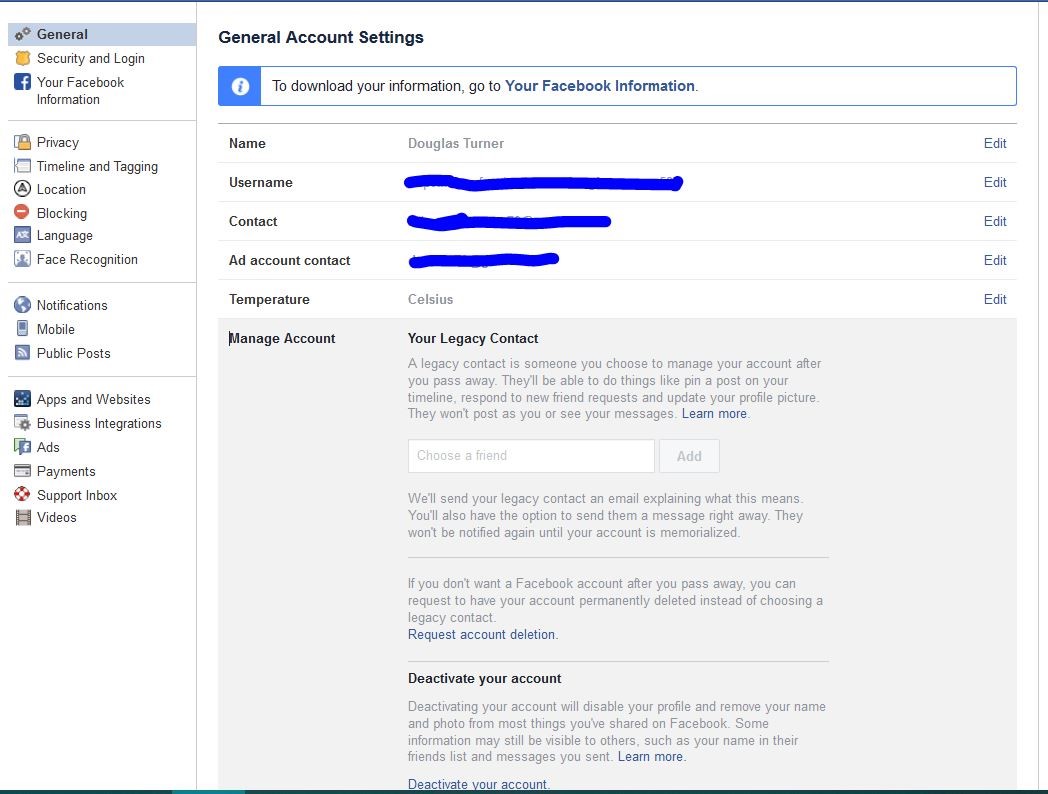

Facebook

You can memoralise your Facebook account. You nominate someone to take control after you have passed away. Alternatively, you can request for your account to be permanently deleted. You can inform Facebook in advance if you would like your account to be memoralised or permanently deleted.

- A legacy contact is someone you choose to look after your account if it's memorialised.

- Once your account is memorialised, your legacy contact will have the option to do things like:

- Write a pinned post for your profile (example: to share a final message on your behalf or provide information about a memorial service).

- Note: If your timeline and tagging settings don't allow anyone other than you to post on your timeline, your legacy contact won't be able to add a pinned post to your profile once it's memorialised

- Respond to new friend requests (example: old friends or family members who weren't yet on Facebook)

- Update your profile picture and cover photo

- Request the removal of your account

Memorialised accounts are a place for friends and family to gather and share memories after a person has passed away. Memorialised accounts have the following key features:

- The word Remembering will be shown next to the person's name on their profile;

- Depending on the privacy settings of the account, friends can share memories on the memorialized timeline;

- Content the person shared (example: photos, posts) stays on Facebook and is visible to the audience it was shared with;

- Memorialised profiles don't appear in public spaces such as in suggestions for People You May Know, ads or birthday reminders;

- No one can log into a memorialised account;

- Memorialised accounts that don't have a legacy contact can't be changed.

Google

Google has strict requirements before they will release any information to executors.

Google requires hardcopy information to be posted or faxed to them before they will provide access to the content of a deceased person’s account. The required information includes:

- Your full name, physical mailing address, and email address;

- A photocopy of your government issued ID or driver’s license;

- The Gmail address of the individual who passed away;

- A copy of an email between you and the deceased;

- Proof of death; and

- A probate or other court order stating that you are the lawful representative of the deceased's estate; or if the deceased was under the age of 18 and you are the parent of the individual, a copy of the deceased’s birth certificate.

Google Gmail users will often store more than just their emails on their account. The speaker uses Google Drive to store my photos and important documents. She recently spent 2 years working overseas and did a lot of travelling around Europe. To free up space on my iPhone she stored all her photos on Google drive. If she were to die tomorrow her family would not have access to those photos. (Apparently, she had not shared her password.)

TAB (Totalisator Agency Board)

The TAB can shut down your account if it has been inactive for a year. At the TAB’s discretion, they can credit any money in the account to your estate.

- TAB will shut down your account if has been inactive for a year. Whatever money is in the account at the time, according to their terms and conditions, may go to the TAB (terms and conditions 6.7).

- Some accounts may have significant amounts of money in them such as TAB, online Lotto accounts or Trade Me. Other accounts may have a ‘rolling subscription’ such memberships (Chiefs stadium seats) or Netflix which if not considered may accumulate debt even though you are dead.

- Things can get complicated because of the different rules that different providers have, and even more so when there is money involved.

Terms and Conditions

Do read all the terms and conditions before accepting them. If you didn’t, read them now. Contact the company if you are not happy about what you have already agreed to. Terms and Conditions usually outline what happens when an account holder dies, which gives you the information you need to organise your digital legacy. Organise an “authorised person” to act as your representative.

- As stated previously, different providers have different rules and processes which are outlined in their terms and conditions.

- Most people fail to read the full terms and conditions of a provider before they click “I accept”.

- However, it is important to be familiar with a provider’s terms and conditions if we choose to leave instructions for our executors when we pass away.

- The terms and conditions will usually outline what happens when an account holder dies, which gives you the information you need to organise your digital legacy.

- We do advise, that when setting up any new online account to make provisions, according to the providers terms and conditions, for an “authorised person” to access your account or at least look into the options of what will happen to your account once you die and to pre-empt that by putting steps into place.

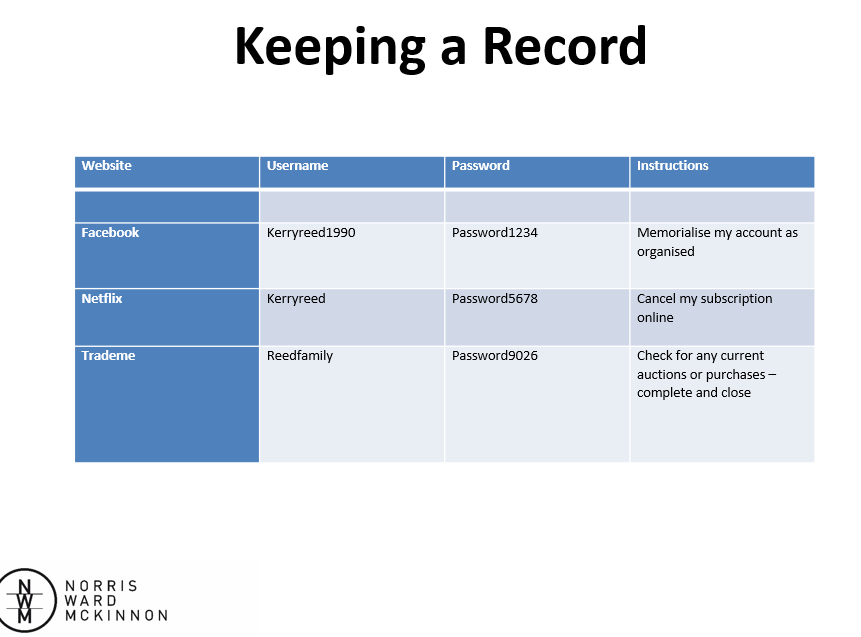

Passwords

Keep a record of your passwords somewhere safe. Keep this up to date and be careful with your internet banking details or passwords. You can keep all your passwords in a spreadsheet which is password protected. If you use a really strong password such as ImB(0)BiNs (a favourite ad) your passwords should be secure. Keep them on a memory stick that is not usually active and they won’t be hackable online.

- Most providers will state in their terms and conditions that you cannot share your password with others, so how do we deal with our digital assets?

- In the USA, a uniform law has been passed governing the rights of executors to obtain disclosure from third parties of the digital assets of a deceased so they deal with their accounts and digital assets. So far, however, there are no signs of any development in this area so what are our options? Currently, our only option is to flout the terms of use by giving our passwords and usernames to our executors.

- Passwords are crucial to the whole issue of digital legacy. The difference between executors having them and not can be huge for bereaved families.

- If you have written down all your passwords it’s easy for them to log onto your emails and say please cancel such and such etc.

- So where should you store your passwords? Typically people will not store their digital passwords with their lawyer. This is because these are changed regularly and it is expensive to constantly update your digital checklist if it is held by your solicitor. Your best option is to tell your executor where you store your information regarding your digital accounts i.e. on your computer and let them know your computer password.

- The reason you would not store your password information in your Will as if probate is granted your Will becomes public record and anyone can view your password information.

- We do not advise that you record your internet banking details or passwords as it is strictly prohibited by banks and to do so is breaching legal terms and conditions. There is also a huge security risk by having banking passwords stored at home.

Digital Legacy Checklist

Keep a list of your online accounts and passwords and update regularly. (Delete accounts when no longer required). If possible, organise someone who will take control of your accounts after you have passed away. This could be the person you could entrust your master password and the whereabouts of your password lists. Credit cards and money based accounts e.g. TAB can continue to be charged. Make sure these are cancelled.

- It is becoming more and more important to make a digital assets list for your loved ones or executors

- This is because if there are no instructions in your Will as to what online accounts you have and what you want to be done with those accounts they could sit there in perpetuity; gaining debt, lying dormant with credit card details, or credit that could be collected by your estate.

Why should you Worry?

Digital Property is a part of your legacy and you should have some say in how they are managed after you have passed away. A few simple steps can make things a whole lot clearer and easier to manage for your family.

- Make a list of your online accounts, and put instructions alongside as to how you want the account to be dealt with when you die. A simple Excel spreadsheet should work.

- Update it every time you open or close an account. It takes just a couple of minutes

- Make an effort to read through, or at least skim through the terms and conditions as to what happens to your account when you die, and if you are required to take active steps such as in Facebook to assign a legacy contact, then do so, and make a note of it.

- Let your executor know how to deal with your online assets –preferably someone who is comfortable with computers, tell them where you keep this list.

The above information is based on a presentation given by Kerry Reed, NWM Law Firm at the 2018 SeniorNet Federation Symposium. Some extra material has been added by SeniorNet Glenfield.